Our stock market performance

Since LACROIX’s IPO, three stages have marked our stock market performance:

- In 1992, 15% of the capital was put on the market;

- In 2005, capital was increased by €16M.

- In 2021, capital was increased by €44.3M.

Today, 38% of the shares are the object of exchanges in section B of Euronext, 62% being held by the Bedouin family.

We ensure to keep the market informed of the Group’s business areas. Also, investors’ breakfasts, SFAF (Société Française des Analystes Financiers [French Financial Analysts Society]) meetings, participation forums and one-to-ones, regularly complete our list of legal publications.

LACROIX shares are eligible for the Equity Savings Plan for SMEs.

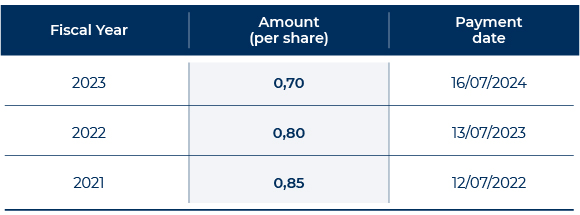

Our dividend policy

All LACROIX shareholders share in the company’s financial performance through a regular dividend policy. For 2022, the payout ratio is 33% of net income (i.e. a coupon of €0.80 per share), after 32% a year earlier.

LACROIX Shareholders’ Club

The purpose of LACROIX Shareholders’ Club, which is open to all shareholders holding one share or more, is to strengthen the proximity with the Company’s shareholders. The aim is to enable shareholders to learn more about the company’s business and strategy by attending exclusive presentation meetings in the presence of the executives.

|

|

|

Our strategic plan and perspectives for the future

LACROIX has set new ambitions, after Ambition 2020, with a new 5-year strategic plan : Leardership 2025.

This plan aims to enable our customers to build and manage smarter living ecosystems through useful, robust and secure connected technologies.

LACROIX is positioned as a player in useful technology with a positive impact strategy based on 4 commitments:

- Grow positive impact business

- Design eco-efficient solutions

- Run sustainable operations

- Commit to our people and regional presence

Your contact

Nicolas Bedouin

Executive Vice-President Finance

Tel.: 02 72 25 68 80

E-mail: investors@lacroix.group

Press releases

- Press release – Financial year 2023

- Press release – LACROIX and AIAC finalize the sale/acquisition of the Road Signs Business Unit

- Press release – Q4 2023 and full-year 2023 revenue

Regulated informations

See all regulated informationsFinancial information meetings

See all financial presentationsDevelopment of the Group

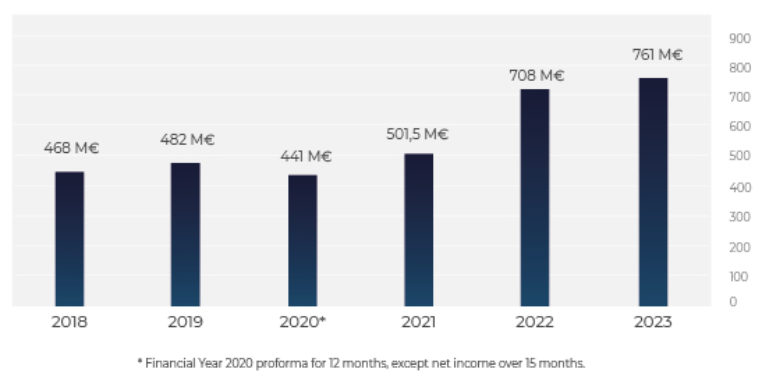

Thanks to our solid financial base, we have enjoyed over 20 years of constant increase in our turnover.

Our key figures

-

Turnover 2023

€761 M

-

Current Operating Profit

€17.9 M

-

Net income - Group share

€4.3 M

-

Number of staff

5080

Stock market price

LACROIX Group : 23.8 EUR ▲ 0.5

FR0000066607 LACREuronext Paris Data – real time

Are you a journalist?

Find the press releases, press materials and information of interest to you in our dedicated zone.

Explore